Market Report Points to Tough Times Ahead for EU Agriculture

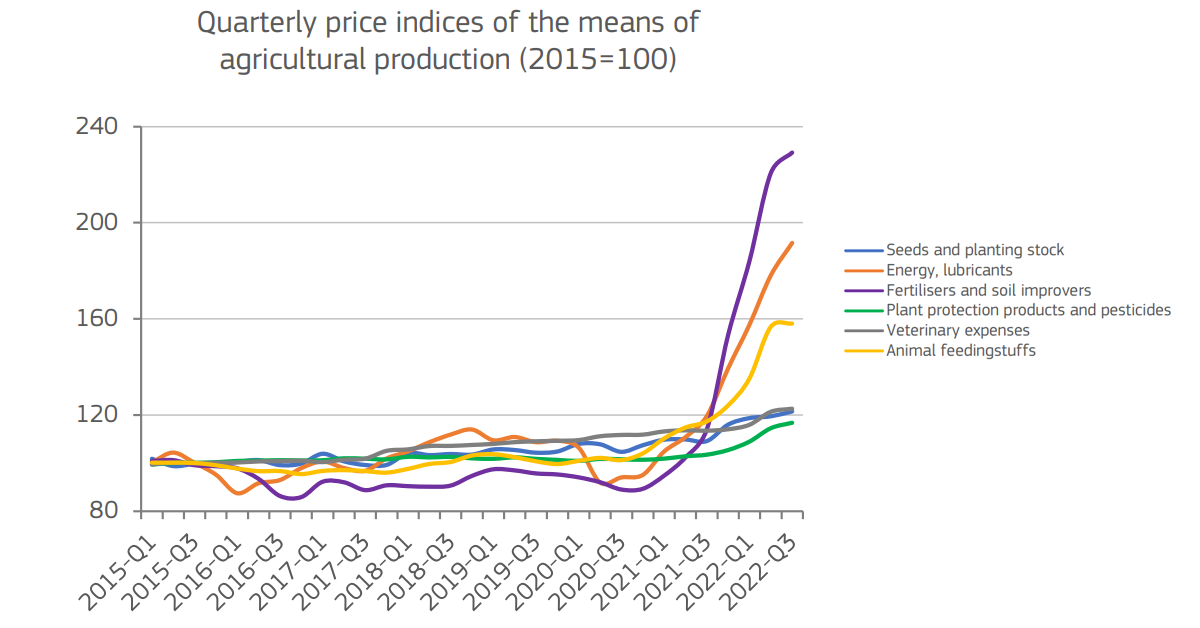

A recent market report published by the Commission has revealed that the EU agricultural sector is facing multiple pressures in 2023. The high costs of feed, energy, and labor are causing farmers to struggle to maintain profitability. Additionally, the lingering effects of the COVID-19 pandemic, HPAI and ASF outbreaks, and geopolitical tensions are affecting the market for agricultural products. Here is a breakdown of the outlook for different agriculture sectors in the EU.

Cereal Production

EU cereal production is expected to decline by 4.4% in 2023. This decrease is mainly due to lower yields and acreage. Drought and other weather conditions are contributing to lower yields. The cost of inputs, such as fertiliser and pesticides, is also a significant factor in the decline.

Oilseed Production

EU oilseed production is expected to decrease by 3.3% in 2023. This decrease is due to lower yields and acreage. The rise in energy costs and declining soil fertility are contributing to lower yields.

Dairy Production

EU dairy production is expected to increase by 0.8% in 2023. However, this is a slower growth rate than in previous years. High feed prices and increasing energy costs are affecting dairy farmers' profitability. These pressures are leading to a decrease in the number of dairy cows. The current market environment favors low-fat milk products, which are in higher demand.

Beef and Veal Production

EU beef production is expected to decline by 1.6% in 2023. The number of suckler cows in the EU has declined for the third year in a row. This trend, along with lower numbers of male bovine cattle for slaughtering between 1 and 2 years, is causing a decrease in beef availability. The decline in production is also due to the high costs of feed and labor.

Poultry Production

EU poultry production decreased by 1.7% in 2022 but is expected to recover by 1.1% in 2023 due to a decrease in feed and energy costs. Import from Ukraine and Brazil increased by 15% and 7%, respectively. Exports declined by 9% due to the Highly Pathogenic Avian Influenza and Russia's invasion of Ukraine. EU poultry consumption is expected to grow by 2.5%.

Pigmeat Production

In 2022, EU pigmeat production decreased by 5.6%, with major producers such as DE, PL, DK, ES, BE, and IT recording high decreases. The number of breeding sows decreased by 4.6% in 2022, following a decline of 3.6% in 2021. African Swine Fever (ASF) is expected to continue to trigger strong responses in affected countries and trade partners in 2023, leading to a further decrease in pigmeat production by 5%. Due to high prices, EU pigmeat exports declined by 16% in 2022, with China reducing its imports by 50%. Meanwhile, EU pigmeat imports from the UK increased by almost 28% in 2022. Due to tight supply, EU domestic use decreased by 2.8% in 2022, averaging at 31.8 kg per capita, and it is expected to further decrease in 2023 by 5.9%.

Sheep and Goat Meat Production

EU sheep and goat meat production is expected to decrease by 1.2% in 2023. The decline is due to a significant reduction in the size of the sheep and goat flock in the EU. The cost of inputs, such as feed and labor, are also contributing to the decline.

The EU's agricultural sector is facing a very challenging year, with high feed and energy costs, weather conditions, and declining soil fertility causing declines in production across multiple agriculture sectors. Additionally, geopolitical tensions, in particular the Russian invasion of Ukraine, waning impacts of COVID-19, as well as HPAI and ASF outbreaks continue to have a disruptive effect on markets. These challenges are taking a heavy toll on farmers and will very likely continue to impact the industry in the coming years.